Medicare Graham - The Facts

Medicare Graham - The Facts

Blog Article

Some Known Details About Medicare Graham

Table of ContentsNot known Factual Statements About Medicare Graham How Medicare Graham can Save You Time, Stress, and Money.The 10-Second Trick For Medicare GrahamThe smart Trick of Medicare Graham That Nobody is DiscussingThe 7-Second Trick For Medicare Graham

A person who takes part in any one of these policies can approve power of attorney to a relied on individual or caretaker in case they end up being not able to manage their events. This implies that the individual with power of lawyer can administer the policy on behalf of the strategy owner and watch their medical details.

Medicare Graham - Truths

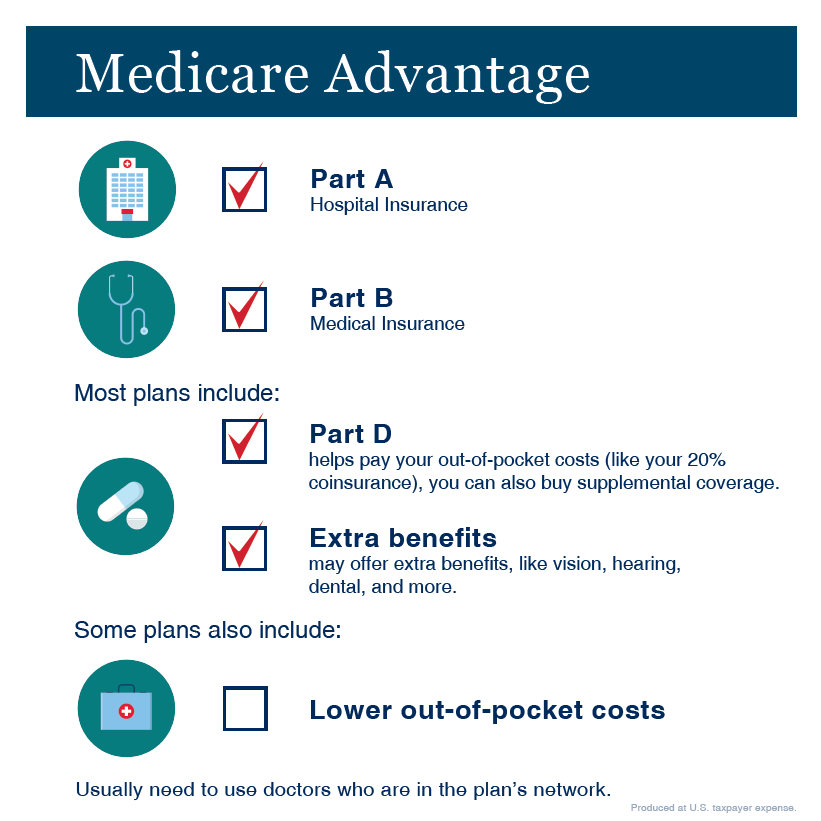

Make sure that you comprehend the fringe benefits and any benefits (or freedoms) that you may shed. You may desire to take into consideration: If you can change your current medical professionals If your medications are covered under the plan's medicine checklist formulary (if prescription drug insurance coverage is supplied) The regular monthly premium The expense of coverage.

What extra services are supplied (i.e. preventive care, vision, dental, health club membership) Any kind of treatments you require that aren't covered by the strategy If you wish to enlist in a Medicare Advantage strategy, you must: Be eligible for Medicare Be signed up in both Medicare Component A and Medicare Component B (you can examine this by referring to your red, white, and blue Medicare card) Live within the plan's service location (which is based upon the area you live innot your state of house) Not have end-stage renal condition (ESRD) There are a couple of times during the year that you might be qualified to alter your Medicare Advantage (MA) strategy: The happens yearly from October 15-December 7.

Your new coverage will begin the first of the month after you make the button. If you need to change your MA strategy beyond the conventional registration periods described above, you might be qualified for an Unique Enrollment Period (SEP) for these qualifying occasions: Moving outdoors your plan's insurance coverage area New Medicare or Part D strategies are readily available due to an action to a brand-new permanent place Lately released from prison Your plan is not renewing its contract with the Centers for Medicare & Medicaid Services (CMS) or will certainly stop supplying advantages in your area at the end of the year CMS might additionally develop SEPs for sure "outstanding conditions" such as: If you make an MA registration redirected here demand right into or out of an employer-sponsored MA plan If you want to disenroll from an MA plan in order to enroll in the Program of Complete Look After the Elderly (RATE).

The Buzz on Medicare Graham

citizen and have ended up being "lawfully present" as a "professional non-citizen" without a waiting period in the United States To validate if you're qualified for a SEP, Medicare South Florida.contact us. Medicare Lake Worth Beach.

Second, check out regular monthly costs and out-of-pocket costs. Determine just how much you can invest based on your spending plan. Third, take into consideration any type of clinical solutions you may require, such as verifying your current doctors and experts accept Medicare or locating coverage while away from home. Review concerning the insurance policy firms you're thinking about.

An Unbiased View of Medicare Graham

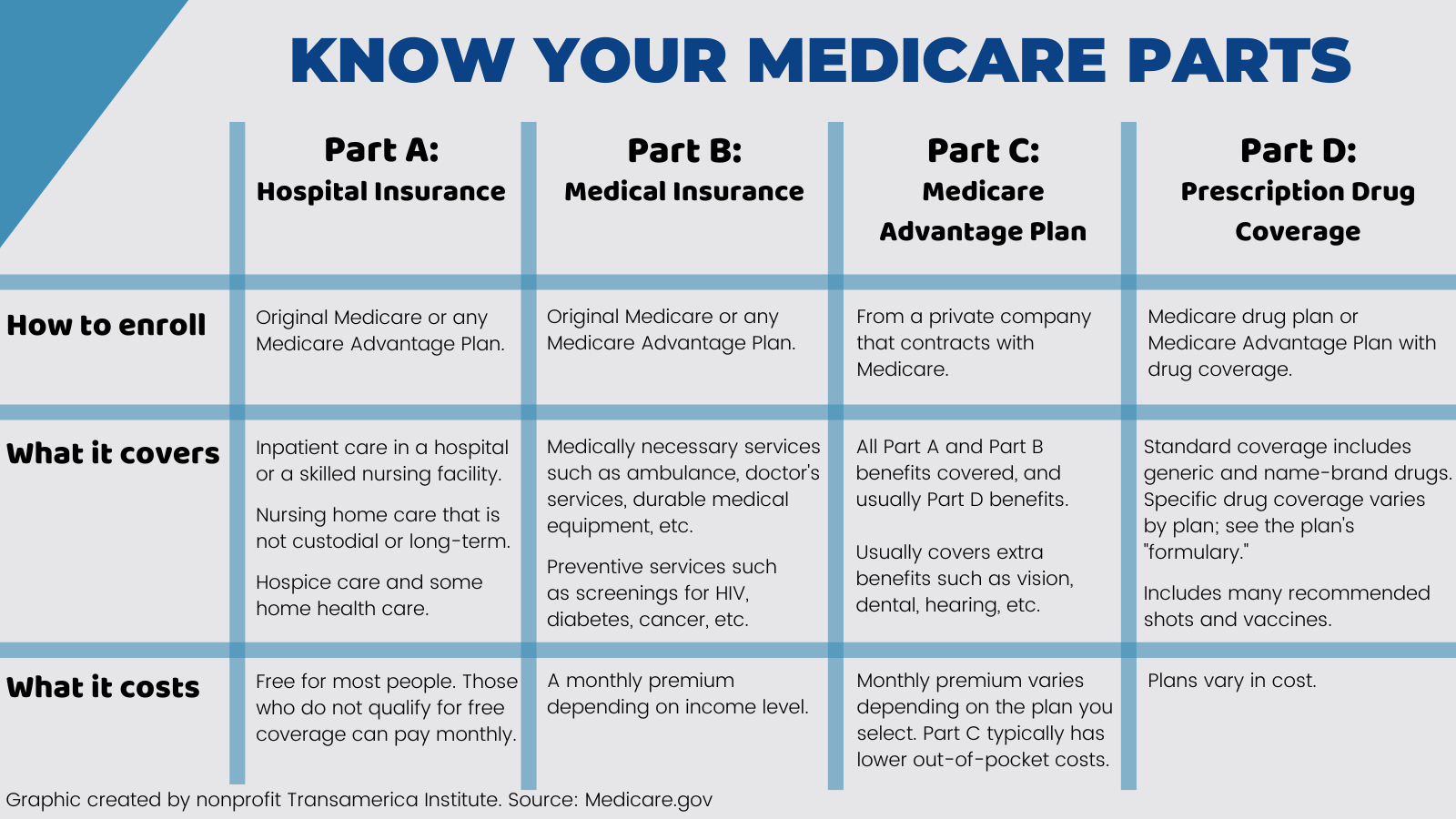

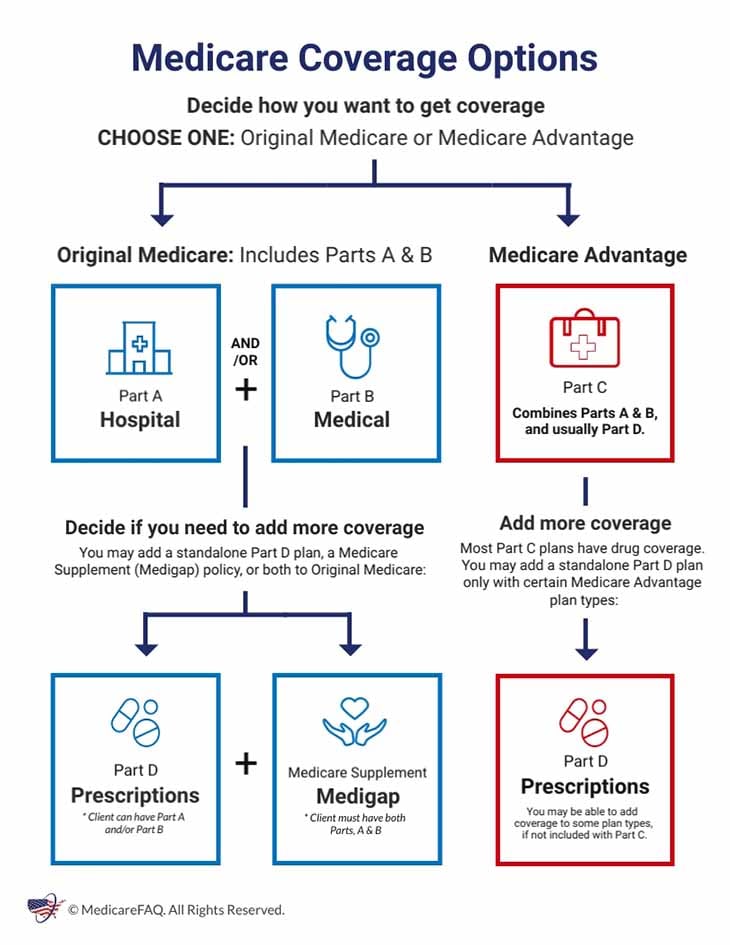

To choose the appropriate protection for you, it's important to recognize the fundamentals concerning Medicare - Medicare. We've gathered every little thing you need to understand about Medicare, so you can pick the plan that best fits your needs. Let's walk you with the process of exactly how to examine if a Medicare supplement plan may be best for you.

Medicare supplement strategies are simplified right into courses AN. This classification makes it less complicated to compare several extra Medicare strategy types and pick one that best fits your requirements. While the standard benefits of each sort of Medicare supplement insurance policy plan are consistent by service provider, premiums can range insurance policy companies.: In addition to your Medicare supplement plan, you can select to buy added insurance coverage, such as a prescription medication strategy (Component D) and dental and vision coverage, to aid satisfy your particular needs.

You can find a balance in between the plan's price and its insurance coverage. High-deductible strategies provide reduced costs, but you may need to pay more out of pocket. Medicare supplement plans usually have a consistent, foreseeable bill. You pay a regular monthly costs in exchange for reduced or no extra out-of-pocket prices.

A Biased View of Medicare Graham

Some strategies cover international travel emergency situations, while others omit them. Detail the clinical services you most value or may need and make certain the plan you select addresses those requirements. Personal insurance companies offer Medicare supplement strategies, and it's recommended to read the small print and contrast the value different insurance firms provide.

It's constantly a good concept to speak to reps of the insurance companies you're thinking about. Whether you're switching over Medicare supplement strategies or shopping for the very first time, there are a few points to think about *.

Report this page